Carbon Credits Still Being Used

A carbon credit is a token that allows companies or individuals to offset their own greenhouse gas emissions. The credits can come from a wide variety of projects that reduce, avoid or capture GHGs, such as planting trees or capturing coal emissions. These projects can be run by middlemen, who sell the credits to businesses looking to offset their own emissions, or they can be created through the voluntary market.

Most large corporations have set a blueprint for going net zero with their emissions, but sometimes the amount of carbon credits they receive each year won’t be enough to cover all their emissions. That’s where carbon markets come in. These are two distinct markets with different rules and oversight: a regulatory market (called a compliance market) and a voluntary market, where companies participate of their own accord.

In the regulatory market, governments establish a limit on how much CO2 a company can emit each year — a so-called cap. Companies that want to exceed that cap must purchase carbon.credit from other companies that have excess emissions room in the compliance market, which operates globally under various laws and regulations including the Kyoto Protocol.

Are Carbon Credits Still Being Used?

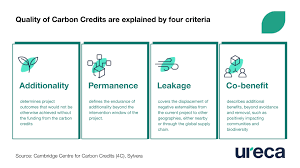

This system has many flaws, including the fact that it’s difficult to ensure that all of the credits sold are actually being used as intended. Also, there’s the risk of “leakage” – where businesses can buy credits from one place, but their activities simply shift to another region that doesn’t have emission caps or regulations in place.

The voluntary market, on the other hand, is a lot more loosely regulated and often unchecked by government agencies. Instead, it depends on a handful of respected standards organizations to validate the credits that make their way into the market. But this system has its own issues, including long lead times when verifying new credits and a lack of market demand for carbon credits.

One of the biggest problems with this market is the lack of a clear definition of what makes a high-quality carbon credit. And that means there are a lot of low-integrity credits out there. For example, some investors buy carbon credits from farmers who plant trees, which is great for the environment and local communities, but it’s not a permanent fix to climate change.

To really have an impact on climate change, both of these markets need to be improved. We need better guidelines for companies to follow on how to use carbon credits; more industry-wide collaboration, where companies might align their emissions-reduction goals with those of other businesses; and stronger protocols for tracking and promoting the sale of credits, such as using blockchain technology to create an unalterable record of the transaction. This can help to increase the demand for credits and spur companies to take further action in their day-to-day operations, such as opting for sustainable infrastructure and encouraging environmental awareness with employees. But the most important thing to do is continue to cut carbon emissions as much as possible.